News & Insights

USMCA Certification Requirements and Sample Template

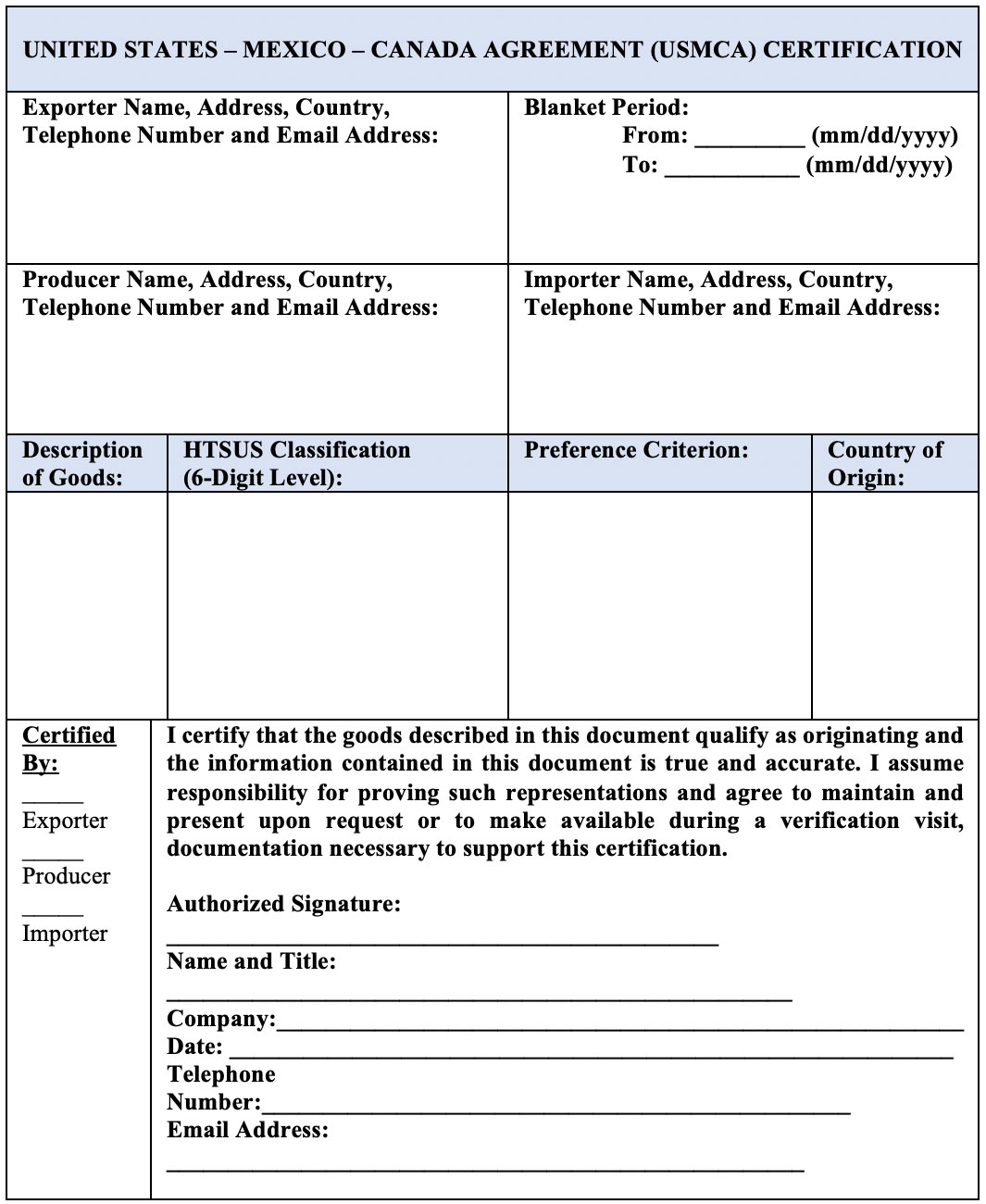

Under the United States-Mexico-Canada Agreement (USMCA) that entered into force on July 1, 2020, there is no required certificate of origin form or specified format for exporters, producers, or importers to use to certify that their goods satisfy the USMCA origin criteria and qualify for preferential trade benefits. Instead, importers must have a written certification in their possession that confirms that the imported merchandise is an originating good under the USMCA. Such a certification can be completed by the importer, exporter or producer and—

- May be provided on the invoice, any other document, or in electronic format;

- May cover a single shipment or multiple importations within a maximum 12-month period;

- May be submitted in English, Spanish, or French (however, if submitted in Spanish or French, an English translation must also be provided); and,

- Must include the following data elements: name, address and contact information of the exporter, producer and importer; identification of the certifier; HTSUS classification of the goods; the USMCA origin criteria under which the products qualify for preferential tariff benefits; blanket period of the certification; signature; date; and, the signer’s certification statement.

Keep in mind that certain products, such as automotive goods, require additional certifications. For example, three additional certifications are required of producers of passenger vehicles, light trucks, and heavy trucks: Labor Value Content (LVC) Certification; Steel certification; and, Aluminum certification. Notwithstanding, a USMCA certification of origin is not required for a non-commercial importation of a good, or for a commercial importation for which the value of the originating goods does not exceed US $2,50

In order to streamline and create uniformity in the process of qualifying and certifying products for USMCA benefits, many companies are creating their own certification templates. We have prepared a general sample form, shown below, that can be adopted and modified as needed. Please see below:

This certificate consists of _______pages, including all attachments.

*************************************************************************************

Preference Criteria Instructions:

With respect to Originating Goods and except as otherwise provided, each Certificate of Origin shall state that a good is originating if it is:

(a) wholly obtained or produced entirely in the territory of one or more of the Parties, as defined in Article 4.3 of the Agreement (Wholly Obtained or Produced Goods);

(b) produced entirely in the territory of one or more of the Parties using non-originating materials provided the good satisfies all applicable requirements of Anne 4-B of the Agreement (Product-Specific Rules of Origin);

(c) produced entirely in the territory of one or more of the Parties exclusively from originating materials; or

(d) except for a good provided for in Chapter 61 to 63 of the Harmonized System: (i) produced entirely in the territory of one or more of the Parties; (ii) one or more of the non-originating materials provided for as parts under the Harmonized System used in the Recovered Materials Provision USMCA NAFTA production of the good cannot satisfy the requirements set out in Annex 4-B (Product-Specific Rules of Origin) because both the good and its materials are classified in the same subheading or same heading that is not further subdivided into subheadings or, the good was imported into the territory of a Party in an unassembled or a disassembled form but was classified as an assembled good pursuant to rule 2(a) of the General Rules of Interpretation of the Harmonized System; and, (iii) the regional value content of the good, determined in accordance with Article 4.5 (Regional Value Content), is not less than 60 percent if the transaction value method is used, or not less than 50 percent if the net cost method is used; and

(e) the good satisfies all other applicable requirements of this Chapter.

News & Insights

OFAC Extends Wind-Down and Maintenance Period for United Company RUSAL PLC under the Ukraine/Russia Related Sanctions

On April 23, 2018, the Treasury Department’s Office of Foreign Assets Control (OFAC) extended the wind-down period for United Company RUSAL PLC (hereinafter “RUSAL”), the world’s second largest producer of aluminum and one of the companies added to the Specially

BIS Adds 60 New Parties To The Entity List

Today, the Commerce Department’s Bureau of Industry and Security (BIS) amended the Export Administration Regulations (EAR) (15 C.F.R. Parts 730 – 774) by adding sixty (60) parties from China, France, Hong Kong, Indonesia, Malaysia, Oman, Pakistan, Russia, Switzerland and the